Chinese Smartphone Market Performance in Q4, 2023

- Produced by Sohu Technology

- Author Zhang Yating

On January 26th, IDC and Counterpoint, among other research institutions, released data on the fourth quarter performance of the smartphone market.

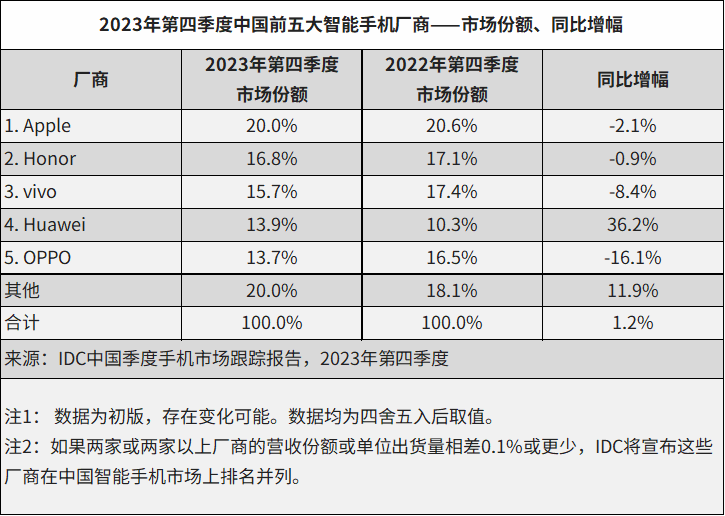

According to IDC, in the fourth quarter of 2023, the shipment volume of smartphones in China reached approximately 73.63 million units, representing a 1.2% year-on-year growth and marking the first rebound after continuously declining for 10 quarters.

Looking at the entire year, the smartphone shipment volume in China for 2023 stood at around 271 million units, a 5.0% year-on-year decrease, marking the lowest shipment volume in nearly 10 years. Despite the gradual improvement in market demand and conditions in the second half of the year due to an improved economic environment, the market performance as a whole failed to meet expectations and has yet to fully recover.

IDC pointed out that the current market demand mainly comes from high-end consumers in tier 1-3 cities. Products with strong sales performance are mainly concentrated in flagship product series such as the Apple iPhone 15, Huawei Mate 60, Xiaomi 14, and Vivo X100. However, the sales of mid to low-end products responsible for overall market volume did not show significant improvement.

In terms of market ranking, Apple remains the top domestic vendor. According to IDC data, Apple holds the first position with a 20% market share, despite a 2.1% year-on-year decrease in shipment volume.

IDC believes that although Apple is facing significant competition in the high-end market from domestic competitors and its limited product upgrade has led to diminished appeal, substantial price cuts through third-party channels have still attracted considerable consumer demand.

Counterpoint pointed out that in the fourth quarter of 2023, Apple faced intense competition from Huawei, resulting in a relatively weak performance for the iPhone 15 series.

Not long ago, Apple implemented “Chinese New Year Limited-Time Offers” from January 18th to 21st, which applied to almost all Apple products and offered maximum discounts of up to 800 yuan. This included a maximum discount of 500 yuan for all models of the iPhone 15 series, iPhone 14, iPhone 14 Plus, or iPhone 13.

Industry insiders believe that due to increased competition in the high-end market brought about by Huawei’s return and the resulting pressure on Apple’s inventory, Apple intensified promotional efforts to alleviate inventory burdens.

Huawei emerged as the strongest performer in terms of sales in the fourth quarter. According to IDC data, with the release of new models such as the Mate60 series under the backdrop of the Kirin 5G chip return, Huawei’s sales grew by 36.2%, making it the fastest-growing vendor among the top five manufacturers.

This achievement is not easily attained for Huawei. Affected by chip shortages, Huawei was pushed out of the global top five in the second quarter of 2019 and dropped out of the top five in the domestic market for the first time in the third quarter of 2021.

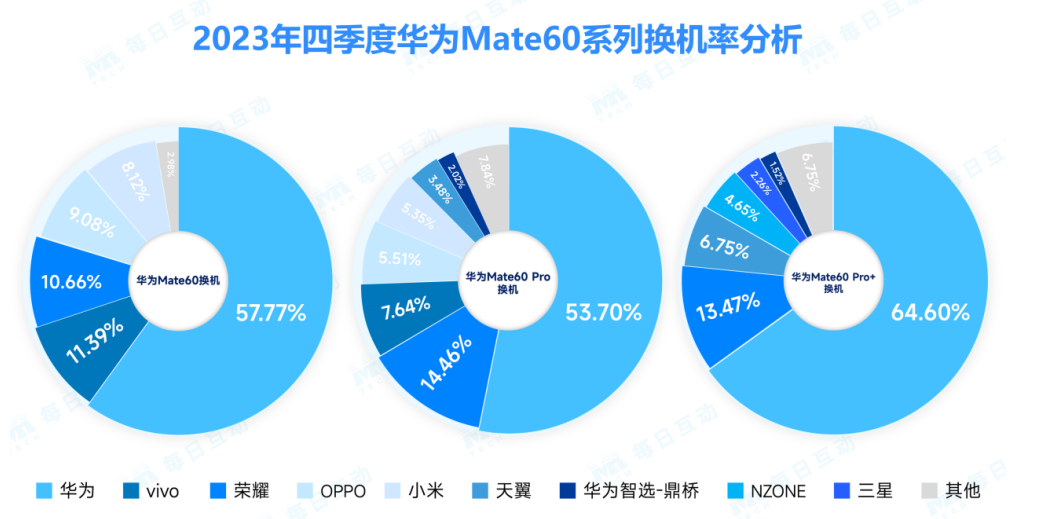

Data from Gartner shows that Huawei users accounted for over 50% of users upgrading to the Huawei Mate60 series, followed by users of Honor, Vivo, and Tianyi mobile phones.

Looking ahead to 2024, Counterpoint Research predicts that the Chinese smartphone market will achieve single-digit year-on-year growth, marking a recovery after five years.

In late 2023, Huawei launched the mid-range Nova 12 series with the 5G Kirin chip, which is expected to continue attracting loyal users. Apple, in January, implemented price reductions to counter the pressure from local smartphone brands.

Meanwhile, IDC maintains a cautiously optimistic outlook on the market performance in 2024. Whether the replacement demand from consumers in the 4th to 6th tier cities can be stimulated will be a key factor influencing the market’s rebound.

IDC suggests that the entire industry needs to maintain a conservative and practical operational strategy, control inventory, and stabilize cash flow.