Introduction

On March 30, 2021, Xiaomi’s CEO Lei Jun announced his “last major entrepreneurial project in life” – Xiaomi Cars during a conference.

Now, as the three-year deadline approaches, Xiaomi Cars’ “Dragon King returns.” Lei Jun revealed on Weibo that Xiaomi will unveil the Xiaomi SU7 on March 28.

Moving into 2024, the entire automotive industry is even more competitive. Price reduction has become a perpetual topic, with slogans like “electric cheaper than gasoline,” “gasoline cheaper than electric,” and “electric cheaper than electric” echoing around. With products from various brands decreasing in price, can Xiaomi’s SU7, the last train for new energy vehicles, distinguish itself among numerous competitors?

The main attraction remains its intelligence

During the technical communication session on December 28 last year, Xiaomi had already disclosed the basic specifications of SU7.

The vehicle boasts the size of a C-segment car, a wind resistance coefficient of 0.195Cd, 0-62 mph acceleration in 2.78 seconds, a top speed of 165 mph, a braking distance of 33.3m from 62-0 mph, dual-motor all-wheel drive, front double-wishbone and rear five-link independent suspension, quadruple braking safety mechanism, a 16.1-inch 3K ultra-clear screen, CLTC working condition 500-mile range, and 800V high-voltage fast charging, among other features.

Electric vehicles do not require gearboxes and engines, and the large bottom battery facilitates weight distribution design, making it challenging for major car manufacturers to differentiate at the hardware level. New energy vehicles are trending towards digital product development. With hardware configurations gradually becoming standardized, differentiation will rely on systems, software, ecosystems, intelligent driving, and control – areas where Xiaomi excels, and are at the core of the Xiaomi SU7’s competitive edge.

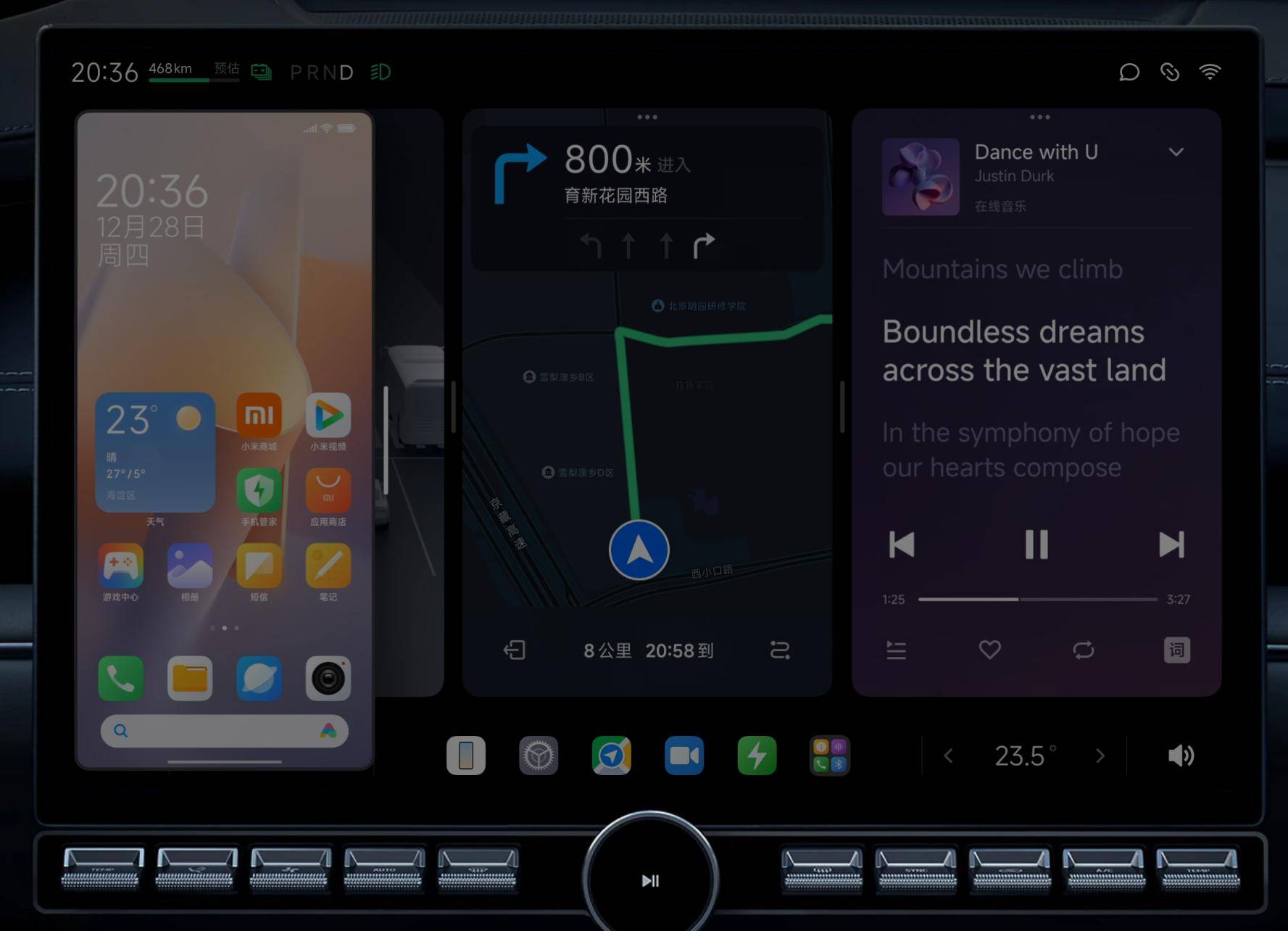

Based on HyperOS, Xiaomi’s intelligent cabin follows a consistent design philosophy with Xiaomi’s phones, tablets, and other devices. Desktop applications, fonts, icons, animations, etc., can all be customized and rearranged at will. A video from a Bilibili blogger showcasing the central control screen of the Xiaomi SU7 reveals a UI design style highly similar to Xiaomi tablets, with application shortcut icons at the bottom and a smooth operating experience. This unified design philosophy helps reduce user learning curves.

Furthermore, while many domestic car manufacturers equip their products with Qualcomm chipsets operating on Android-based car systems, they often fail to open up their ecosystems, rendering the powerful car chipsets merely ornaments.

In contrast, Xiaomi SU7 will gradually share over 5,000 applications from Xiaomi tablets and support cross-screen applications from mobile phones on the car system. With the extensive ecosystem of tablets and smartphones, the Xiaomi SU7 car system will offer users a richer array of entertainment, learning, and work functions.

Moreover, Xiaomi SU7 reserves multiple pin interfaces for tablet expansion, supporting up to five-screen linkage. Xiaomi also announced the opening of the CarIoT ecosystem, collaborating with global developers to create a more perfect “people-vehicle-home full ecosystem.”

The Bilibili UP host @汽车闲聊站 mentioned having some initial experience with the Xiaomi SU7. Summarizing, they highlighted the following key points: first, the chassis is excellent, offering outstanding driving experience with adjustable parameters; second, it has strong intelligence, as Xiao Ai Assistant can assist with all necessary operations, including cross-platform operations. Nevertheless, the authenticity of online leaks needs confirmation, and the real situation of the Xiaomi SU7 will be verified only after the actual launch.

In terms of intelligent driving, SU7 is equipped with Xiaomi’s independently developed intelligent driving technology stack. Utilizing two NVIDIA autonomous driving chips, high-definition cameras, LiDAR, mmWave radar, ultrasonic radar, and software algorithms, it can achieve obstacle recognition accuracy of less than 0.1 meters, along with high-speed and urban area assisted driving capabilities.

Unfortunately, while many domestic car manufacturers are incorporating AI models into their vehicles, there is limited information exposure from Xiaomi. Despite continuous investment in AI models for phones, little information is available regarding AI models in cars.

In conclusion, Xiaomi SU7, while ensuring hardware competitiveness, focuses on intelligence, software, and ecosystem as its core competitive advantages. However, the actual product strength of the car will depend on its price. According to Lei Jun, Xiaomi SU7 has high production costs, indicating that the price may not be particularly low. The high-spec version is predicted to be around 350,000 RMB, while the base version may be around 250,000 RMB.

Recently, an alleged price list for the Xiaomi SU7 surfaced online, with the high-spec version priced at 361,400 RMB and the base version at 261,400 RMB – not far from the previous predictions. However, doubts about its authenticity linger, indicating a high chance of it being fake.

Xiaomi is facing a tough challenge – ensuring that the initial production capacity is sufficient to meet consumer demand and determining the timeline for fulfilling orders. Even the Huawei-Chery joint venture, establishing the Zhiji intelligent car, faced production capacity issues. Therefore, Xiaomi, as a pure newcomer in the car manufacturing industry, may face an even more severe delivery situation.

Are they ready for delivery?

From project initiation to the launch of the first product, Xiaomi only took three years. During this period, Xiaomi’s automotive department not only had to design products but also had to focus on building factories, installing equipment, recruiting workers, setting up sales and transportation channels. With the imminent launch of the Xiaomi SU7, has Xiaomi completed all the essential tasks, from production to sales, and then to after-sales service?

On December 26 last year, Lei Jun stated that the Xiaomi SU7 had entered the stage of increasing production capacity. According to 36Kr’s report, by March 2024, the production capacity of Xiaomi SU7 is expected to be around 2000 vehicles, reaching over ten thousand vehicles by July. Along with the vehicles produced in the previous two months, by the end of March, Xiaomi would have around 4000 Xiaomi SU7 units in stock, enough for the initial deliveries.

Regarding car delivery, Xiaomi’s approach is not the traditional direct sales or distribution model but rather the “1+N” scheme. The “1” represents Xiaomi’s self-built delivery centers primarily responsible for product deliveries, covering to some extent sales and after-sales services, initially focusing on certain first and second-tier cities in China.

The “N” refers to service stores that handle product sales and after-sales services, including car maintenance, bodywork repairs, and painting. Despite this, delivery tasks are still managed by Xiaomi’s direct centers. Xiaomi’s extensive network of Mi Stores nationwide will also play a role in showcasing and selling cars to some degree.

The reason for choosing this approach may be Xiaomi’s intention to utilize distribution channels to alleviate its own financial pressures, without relinquishing too much of the pie. In the early stages of the new energy vehicle era, emerging car manufacturers typically opt for direct sales; this works well when production capacity matches demand. However, if production exceeds demand, significant car inventory can put immense pressure on manufacturers.

Hence, in recent years, many newcomers are transitioning towards distribution models, asking dealers to procure a batch of cars to ease the manufacturers’ financial burdens. Recently, some dealers complained about XPeng Motors’ requirement for them to stock inventory. Xiaomi still tightly controls the delivery rights but has delegated sales rights to dealers, possibly due to current lower production volumes that limit the distribution to dealers. It remains uncertain whether Xiaomi will eventually reclaim sales rights as product sales increase or fully adopt a distribution model.

At present, leveraging dealers for sales not only utilizes their influence to boost orders but also alleviates Xiaomi’s own pressures. Some of Xiaomi’s flagship stores with larger spaces may also introduce cars indoors for Mi fans to experience and visit.

Despite Xiaomi paving the way for the arrival of the SU7, whether this car can stand out in the crowded new energy car market remains a question mark.

How to break through the competition?

If there is one word that best describes the Chinese automotive market, “fierce” would come second, while there is no word to claim the top spot.

In a market flooded with models similar to Xiaomi SU7, such as NIO ET7, Xpeng P7, and Zhiji S7, Xiaomi SU7 does not have many hardware advantages. The “Smart Home + Smart Car + Connected Lifestyle” ecosystem could be Xiaomi’s key weapon to gain an edge. Similarly, Huawei, another tech giant venturing into car manufacturing, with brands like Wajue and Zhijue, have secured numerous orders due to their ecosystem, intelligence, and advanced driving capabilities.

Amid the fierce competition in the automotive industry, the value for money of domestic new energy vehicles is improving year by year. Traditional car manufacturers, with in-house hardware development and production, can significantly reduce costs and have a strong foundation for price wars. As a newcomer, Xiaomi undoubtedly lags behind established car manufacturers in self-production rates and even struggles to compete with new players like Wajue and Xpeng. Engaging in price wars may require Xiaomi to accept loss-making competition strategies.

Fortunately, with China’s automotive industry completing the shift from fuel-based cars to new energy vehicles, the industry’s future trajectory and growth potential likely lie in the transition from traditional automobiles to smart and AI-enabled vehicles. Coming from the background of the mobile and internet industries, Xiaomi naturally possesses advantages. From the Xiaomi SU7, we can see its leading position in the field of intelligent ecosystems.

In this era, what cars need to showcase the most are their self-developed core competencies. Lei Jun, known as a pioneer in Chinese internet marketing, will undoubtedly leverage Xiaomi’s self-developed technologies to attract a vast consumer base.

In the rapid development of China’s new energy vehicle industry, from nothing to something, and from something to strength, leading the world, it also means that there are no stones left for us to touch while crossing the river. Every technological upgrade and product launch by domestic car manufacturers is an exploration of the future direction of the industry.

Whether Xiaomi Cars can break through the encirclement, we cannot make reckless conclusions. However, at least we have seen the core competitiveness of Xiaomi Cars – the “Car-Home” ecosystem, and their dedication to intelligence.

As for some netizens’ concerns about the high pricing of Xiaomi SU7 and its potential impact on sales. Xiao Tong has two viewpoints: First, the Mi Fans who supported Xiaomi phones in the past have grown up and have a certain level of purchasing power. Even if a small percentage can afford the Xiaomi SU7, it can still bring in significant orders for this car.

Second, all the price information currently leaked may be a smokescreen. Perhaps Lei Jun will “persuade executives overnight” and eventually announce a price that will “surprise” consumers and the industry, just like the Xiaomi 1 did back in the day.