Overrated Xiaomi: A Closer Look at the Launch of SU7 Electric Car

On the Xiaomi stock bar, a comment before March 28th gained significant attention: “If a mobile phone company can make electric cars, it means that electric cars are as simple as electric scooters and lack any technological complexity. Is this really an innovative move? It seems like a shortcut!”

However, after March 28th, comments like “After watching so many car launch events, Xiaomi has shown sincerity. So why criticize Xiaomi?” started receiving more likes and shares.

The Xiaomi SU7 launch event took place on the evening of March 28th, where Lei Jun spoke passionately for two hours, gradually heating up the atmosphere. At 52 minutes into the event, there were still many people playing with their phones; at 1 hour and 23 minutes, the spotlight was on Lei Bies (Lei Jun’s nickname) when discussing the car-home-life ecosystem; and at 1 hour and 45 minutes, the climax was reached when the prices were finally announced.

With a starting price of 215,900 RMB, a 0-100 acceleration in 2.78 seconds, a standard range of 700 kilometers, an automotive ecosystem involving over 20 Xiaomi products, an official live broadcast that reached 43 million views and 210,000 comments, with over 50,000 orders in just 27 minutes – behind these impressive numbers, Lei Jun’s “betting his reputation” on the car-making business, what are the actual chances for success?

The “Overestimated” Price

Regarding the Xiaomi SU7, what most people care about is still the “price”.

From Xiaomi’s first technical event on December 28, 2023, to the official launch of the Xiaomi SU7 on March 28, 2024, where the prices were revealed, Lei Jun maintained a three-month vacuum period for himself and the SU7. This period was used to think about pricing and to gauge public opinion.

As anticipated by Lei Jun, during these three months, discussions about the price of the SU7 seemed never-ending and intensified as the launch date approached. Unexpectedly, Xiaomi’s entry into the car market was also engulfed in the pricing debate.

Through Lei Jun’s public “teasing” and leaked prices on the internet, discussions on Mi’s forums intensified. Especially after Xiaomi’s first “Ecosystem of Cars, Homes, and People” event on February 22, even though the event did not provide much new information about the SU7, discussions about Xiaomi’s car prices on Mi’s forum overshadowed those about Xiaomi smartphones.

Among the discussions, there were skeptics who commented, “The car-making trend has passed. Unless Xiaomi comes up with a groundbreaking price! Maybe they should just focus on making phones.” Lei Jun probably felt the pressure seeing such sharp remarks. Otherwise, Xiaomi wouldn’t have been up all night discussing prices the night before the launch event.

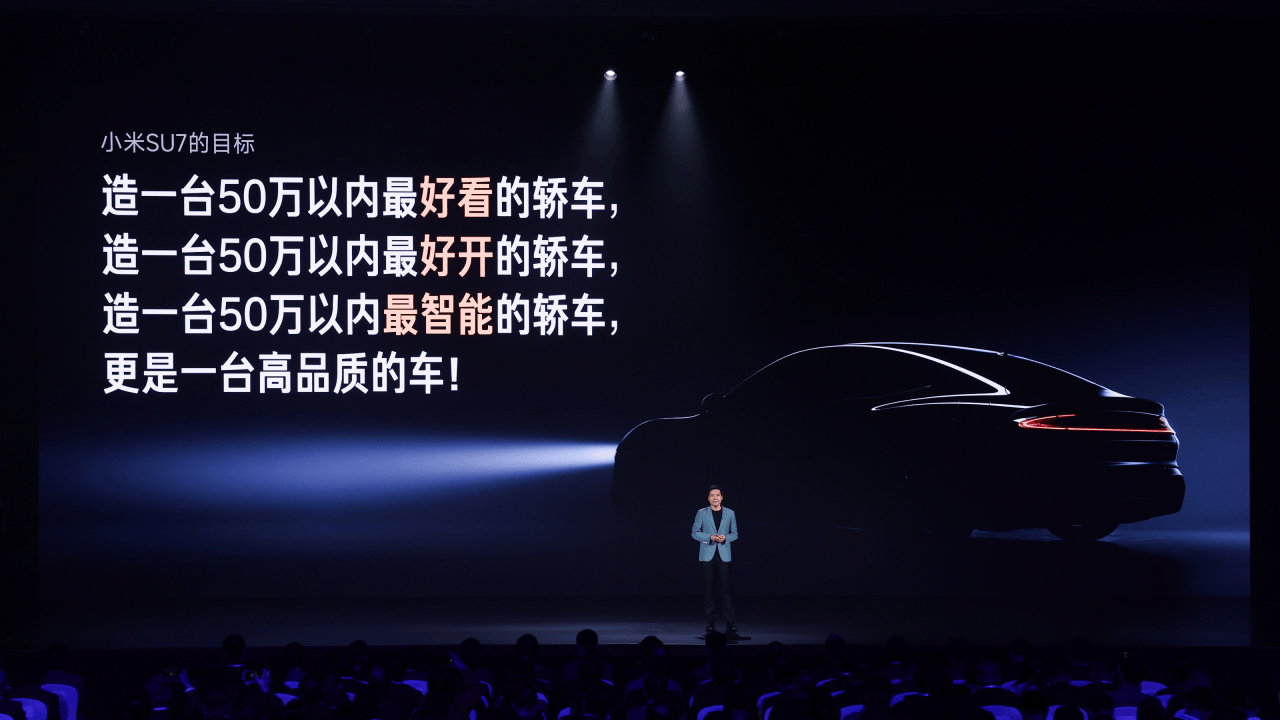

When Lei Jun announced the prices, starting at 215,900 RMB for the Standard version, 245,900 RMB for the Pro version, and 299,900 RMB for the Max version, the audience applauded. Perhaps due to Lei Jun’s repeated statements like “It won’t be 99,000, and not even 199,000,” people had already started expecting higher prices for the SU7. Compared to the rumored price of around 360,000 RMB and the speculated 40,000 RMB based on Lei Jun’s statement of “the best car under 500,000,” the actual prices turned out to be quite affordable.

Since the audience at Xiaomi’s car launch event mainly consisted of industry insiders or loyal Xiaomi fans, their opinions were not entirely representative. After the event, a random survey among friends in a taxi ride showed divided responses – half said “It’s okay” or “It’s acceptable,” while the other half questioned, “Isn’t it better to buy a BBA car with that money?”

On Weibo, contrasting opinions also emerged, with a classic comment saying, “Mr. Lei, we’ve grown up, not just rich,” followed by someone remarking, “If you find it expensive, go buy a BYD Qin for 80,000 RMB next door.”

Looking at the price alone, the starting price of 215,900 RMB is already considered high-end among domestic automakers. It is commonly said that crossing the 200,000 RMB threshold is significant; the difference between “tens of thousands” and “over twenty thousand” sounds substantial. Why did Xiaomi risk losing some fans and set the price above 200,000 RMB? This decision might be related to Lei Jun’s ambitions.

As we all know, Xiaomi entered homes with its cost-effective phones and was labeled as “low-end” and “cheap”. Transitioning from the mid-low-end to high-end in the smartphone market in recent years has been challenging – once a brand image solidifies, changing it is incredibly difficult. Moving towards the high-end was Lei Jun’s challenge, and by venturing into the car industry as a final show in his career, he naturally hoped for success without following the same path as in the smartphone market.

Regarding why the price of the Max version is held under 300,000 RMB, it is likely that this decision was also well thought out by Lei Jun. According to the China Passenger Car Association, pure electric vehicles only account for about 14% of the market for cars priced over 300,000 RMB. In other words, the luxury fuel car market that exists above the 300,000 RMB price point remains a challenging battlefield for electric vehicles. This is underscored by the fact that even the likes of Zeekr 001 and NIO’s ET5, which initially targeted this market, have since readjusted their starting prices to below 300,000 RMB. Lei Jun, recognizing the potential pitfalls, has opted for a strategic sidestep.

Surpassing Market Expectations

The launch event for the Xiaomi SU7 was scheduled for 7 p.m. on March 28th, coinciding with the evening rush hour. Traveling by car from downtown Beijing to the Beiren Yichuang International Convention and Exhibition Center took a full two hours. Hence, as a specially invited guest by Lei Jun, He Xiaopeng, the chairman of XPeng Motors, set off before 5 p.m. Upon his timely arrival, he found himself seated in the front row, flanked on the left by Li Xiang, CEO of Li Auto, and to his right, in order, were Li Bin, the founder of NIO, Wei Jianjun, the chairman of Great Wall Motors, and Zhang Jianyong, the newly appointed chairman of BAIC Group.

As Lei Jun began his product presentation after greeting each dignitary, the posture and expressions of these five industry titans captured by the media cameras evolved from relaxed to attentive, each displaying their own unique intrigue.

During his speech, Lei Jun frequently compared the Xiaomi SU7’s specs and performance directly with those of the Porsche Taycan Turbo and Tesla Model 3. Faced with a plethora of data, Lei Jun concluded, “In major comparisons, the Xiaomi SU7 only falls short in two aspects against the Model 3: power consumption and computing power.”

“As a Tesla and Porsche owner, I have immense admiration for both brands—one represents electric vehicles, and the other sports cars; both are icons of the automobile industry. To embark on car manufacturing, Xiaomi must measure itself against the best. If we shy away from comparison, we cannot succeed.”

Lei Jun exhibited full confidence in challenging traditional car manufacturers, stating, “Intelligence is the soul of a car. As a technology company and a global top-three smartphone brand, Xiaomi’s greatest strength lies in its smart technology. Our capabilities in consumer electronics, operating systems, chip technology, and AI significantly surpass those of traditional car manufacturers. It will be incredibly challenging for them to catch up with Xiaomi.”

Lei Jun’s candidness about both the advantages and challenges reflects his sincerity and Xiaomi’s confident vision.

Yet, the question remains: Is taking the high road of luxury vehicles truly an easy path for Xiaomi? Possibly not.

Pursuing luxury is not just Lei Jun’s dream but also that of Yin Tongyue, chairman of Chery Automobile. As early as 2009, Chery began its high-end transformation in the fuel vehicle sector, becoming the first domestic carmaker to attempt this. In a recent exclusive interview, Yin Tongyue candidly expressed, “No matter the era, creating a high-end brand is extremely challenging.” Success in the high-end market has been elusive for Chinese carmakers during the era of fuel vehicles, and it won’t be any easier in the era of new energy vehicles.

Xiaomi is the only tech giant truly entering the car manufacturing arena, but it’s not the first company to cross over into this space. Take the “three brothers” of NIO, XPeng, and Li Auto, who all entered from the high end and have established themselves in the market, yet only Li Auto has achieved profitability so far.

Looking at the broader automotive market, a tense atmosphere persists. Last year, under the influence of Tesla and BYD, the industry plunged into severe competition. Price reductions in the tens of thousands have become hard to withstand, with “electric cheaper than fuel” replacing “fuel and electric at the same price” as a hot industry topic. The blurring of class distinctions among vehicles, luxury brands moving downmarket, and the extreme pressure faced by all manufacturers are part of the current landscape.

Especially in the last six months, the pure electric sedan market and price range of the SU7 have seen a surge in strong contenders. For instance, the Galaxy E8 with its 800V architecture and Qualcomm 8295 chip is priced between 175,800 and 228,800 RMB; the Zeekr 007, offering 800V high-voltage architecture and a 8295 smart cockpit chip with up to 870 km of range, is priced between 209,900 and 299,900 RMB; and the Star Era ES, featuring 800V fast charging, electromagnetic suspension, dual NVIDIA chips, and a 905 km combined range, falls between 198,800 and 339,800 RMB. Additionally, star models like the Tesla Model 3, BYD Han, NIO ET5, and XPeng P7 also pose significant competition to the SU7.

“Three years ago, at Xiaomi’s official car manufacturing announcement, I said this was my last entrepreneurship journey in life. I am willing to stake all my reputation on Xiaomi cars,” Lei Jun declared. However, to Lei Jun and his supporters’ surprise, the automotive industry has undergone revolutionary changes in just these three years. The once boundless market, the easy-going atmosphere where all entrants could find their niche, and the endless opportunities of a new track have all vanished, replaced by an intensity and competition beyond imagination and expectations.

Non-Negotiable Sales

“Driving sales” became another key phrase at the launch of the Xiaomi SU7.

In addition to the SU7, a wide array of Xiaomi’s peripheral products, including smartphones, phone holders, flashlights, sunshades, charging cables, tablets, tablet stands, karaoke microphones, ambient lights, walkie-talkies, walkie-talkie charging docks, smart fragrance diffusers, outdoor Bluetooth speakers, child safety seats, headrests, trunk organizers, car fridges, premium audio systems, leather seats, mugs, baseball caps, and more, were also featured. In total, nearly 30 product categories were mentioned.

Netizens joked about Lei Jun transforming into a super sales influencer, even voicing concerns for NIO’s own marketplace. On reflection, Lei Jun’s approach might also suggest that sales, or perhaps profit, remains a crucial focus for Xiaomi at this time. Fortunately, SU7’s performance did not disappoint Lei Jun: just 4 minutes after the end of the launch event, it was reported by Quick News that SU7 had reached over 10,000 orders; 27 minutes later, another update stated the orders had surpassed 50,000 vehicles. Checking the Xiaomi Cars app revealed that the limited edition of 5,000 units for both the SU7 Founder’s Edition and the SU7 Max Founder’s Edition were already sold out. Even though regular orders could be canceled within 7 days, this surge in demand reflected the popularity of the SU7.

However, several experienced individuals in the automotive industry pointed out to Car Observers that while impressive order numbers can indicate market acceptance of a new vehicle to some extent, it doesn’t directly translate to actual sales. For instance, BYD Dolphin had over 110,000 orders on the first day of its launch but only delivered 80,000 vehicles in two years; the Avid Twelve reached over 10,000 orders within 24 hours, yet the total sales in the first two months of the year were only 9,516 units; NIO ET5 received over 100,000 orders in 9 days, but the total sales in the past 12 months were only 23,000 units; and the IDEAL L7 had over 30,000 orders in the first 48 hours after its launch, yet the average monthly sales in 2023 barely exceeded 10,000 units…

Based on the experiences of these experts, if Xiaomi SU7 can achieve monthly sales of over 10,000 units within the year, it would already be considered a good performance. Achieving monthly sales of over 10,000 units is a significant milestone for a new automotive brand. It took NIO, XPeng, and Leap Motor 7 years to reach this milestone from their establishment. Even the Jinkang Auto, backed by Geely Auto Group, took a whole year to achieve this.

Even if the market helps Xiaomi smoothly cross this major milestone, there is still a considerable gap from Lei Jun’s expectations. Lei Jun’s ambition is to “enter the top ranks of the industry by 2024” and “become one of the top five global automakers through 15-20 years of effort.” Previously, Lei Jun even stated that to achieve this goal, it would mean “shipping over 10 million vehicles annually.”

Lei Jun once joked, “The character ‘雷’ carries electricity, ‘军’ signifies a vehicle; with Lei Jun making cars, it’s fate.”

Prior to the launch of Xiaomi SU7, Lei Jun posted on his personal Weibo, “This is the first step for Xiaomi Cars and the beginning of the final battle of my life.”

In addition to the determination to outshine Apple and Huawei in car manufacturing, Lei Jun, being astute, has also mentally prepared for the risks and challenges that lie ahead. As he said, “This is a marathon, testing endurance and stamina.”

Of course, as the first mass-produced model of Xiaomi Cars, we sincerely hope that SU7 will give its best shot and, as Lei Jun hopes, “show endurance” and “exert stamina” to achieve great success. Only then can the next act be performed well.