The rise of Android competitors is putting increasing pressure on Apple.

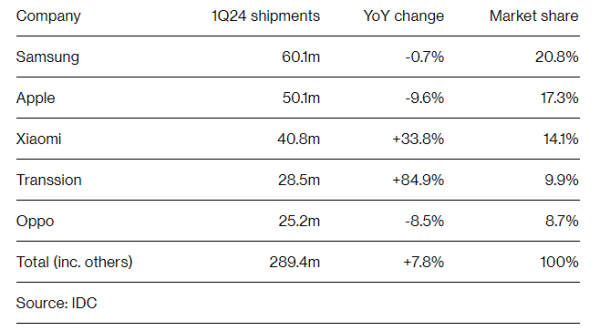

According to media reports on April 15th, preliminary tracking data released by the International Data Corporation (IDC) showed that in the first quarter of this year, global mobile phone shipments increased to 289.4 million units, a year-on-year growth of 7.8%. The data showed that in this quarter, iPhone shipments decreased by nearly 10% year-on-year to 50.1 million units. This allowed Samsung, with shipments of 60.1 million units, to reclaim the top spot in shipments.

In the fourth quarter and the full year of last year, Apple surpassed Samsung to become the world’s largest smartphone manufacturer. However, with Chinese brands such as Huawei continuously gaining market share, Apple’s market share gradually declined to second place globally. IDC research director Nabila Popal said, “Although the top two vendors saw negative growth in the first quarter, Samsung seems to be in a more favorable position overall than in the past few quarters.”

Screenshot from the report. Data source: IDC.

According to reports, South Korean Samsung launched its latest flagship smartphone series, the Galaxy S24 series, earlier this year, with shipments exceeding 600 million units during the period.

In Nabila Popal’s view, the smartphone market is moving away from the turbulence of the past two years but is also experiencing new changes. Data shows that in the first quarter of 2024, Transsion’s shipments surged by 85% to reach 28.5 million units; Xiaomi experienced a rebound with a year-on-year shipment growth of 33.8% to reach 40.8 million units, further narrowing the gap with Apple.

Data from IDC shows that Apple’s iPhone shipments in the first quarter were 50.1 million units, lower than the 55.4 million units in the same period last year.

“As expected, the recovery of the smartphone market continues to advance, and optimism is slowly building among the top brands. Although Apple successfully took the top spot at the end of 2023, Samsung has successfully re-established itself as the leading smartphone supplier in the first quarter. While IDC expects these two companies to maintain control of the high-end market, the resurgence of Huawei in China, as well as significant growth from Xiaomi, Transsion, OPPO/OnePlus, and vivo, may lead these two manufacturers to seek expansion and diversification. As the economic recovery progresses, we may see larger companies gaining market share, while smaller brands struggle to position themselves,” said Ryan Reith, Vice President of IDC.