Indian Smartphone Market Report for Q1 2024

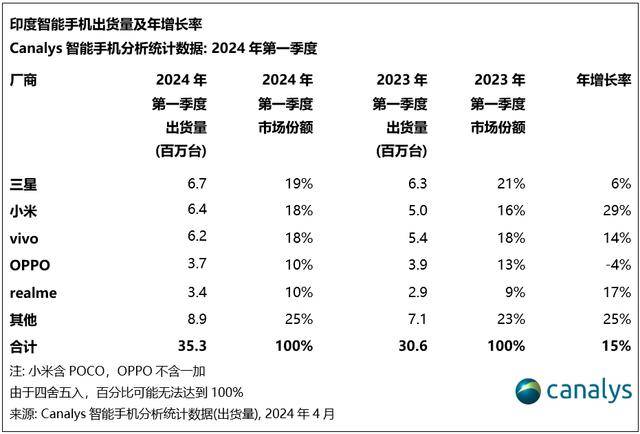

On April 19, market research firm Canalys released the list of smartphone shipment volumes in India for Q1 2024. In comparison to the same period last year, overall shipments increased by 15%, with only OPPO experiencing a year-on-year decline, dropping from the second to the fourth position in India. Samsung temporarily claimed the top spot, while Xiaomi emerged as the dark horse in the list, showing the fastest year-on-year growth among smartphone manufacturers.

According to Canalys data, the total smartphone shipments in India for Q1 2024 reached 35.3 million units, marking a 15% increase from the previous year. Samsung led the pack with 6.7 million units shipped, holding a 19% market share. Its shipments increased by 400,000 units compared to last year, with a 9% year-on-year growth. The gap between Samsung and the second-place contender has been narrowing, decreasing from 800,000 units last year to 400,000 units this year.

In the second spot, Xiaomi shipped 6.4 million units, accounting for an 18% market share, trailing Samsung by only 400,000 units. Compared to Q1 last year, Xiaomi’s shipments increased from 5 million units to 6.4 million units, achieving a 29% year-on-year growth, the highest among all brands on the list. Xiaomi had dominated with nearly 30% market share in Q2 2021, marking a strong comeback after a slump lasting almost three years, indicating a promising future performance.

Taking the third spot, vivo shipped 6.2 million units, holding an 18% market share, trailing Xiaomi by 200,000 units. Compared to Q1 last year, vivo’s shipments increased by 800,000 units, marking a 14% year-on-year growth and placing it fourth in the current list. Assessing the domestic market, vivo dropped out of the top five globally, likely not due to a decrease in total shipments compared to last year but merely because its shipments did not surpass OPPO, ranking fifth.

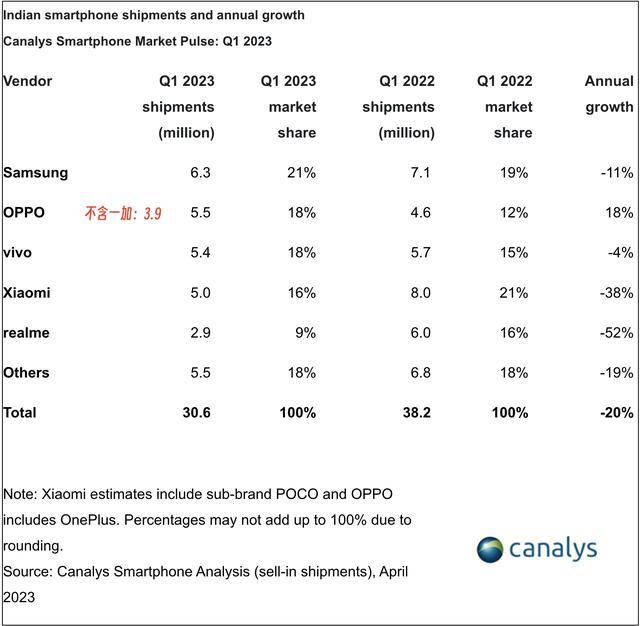

OPPO secured the fourth position, shipping 3.7 million units with a 10% market share. In contrast to last year, its shipments declined by 20,000 units, marking a 4% year-on-year decrease, making it the only manufacturer on the list to experience a decline. It’s worth noting that OPPO does not include OnePlus in this ranking, possibly due to the impending halt of OnePlus sales in offline stores in India, a situation that requires further observation. Simple calculations suggest that OnePlus shipped 1.6 million units in Q1 last year, indicating OPPO’s consideration for its subsidiary brand.

Realme secured the fifth spot, shipping 3.4 million units with a 10% market share, trailing OPPO by only 300,000 units. Compared to last year’s Q1 performance, Realme’s shipments increased by 500,000 units, showing a 17% year-on-year growth, second only to the fastest-growing Xiaomi. Other manufacturers shipped 8.9 million units, holding a 25% market share, with a 25% year-on-year growth rate, indicating that companies like Apple are faring well in the Indian market.

Final Thoughts by the Author:

Regarding the Q1 2024 Indian smartphone shipment rankings, the author observed the following: despite an overall 15% growth, OPPO, vivo, and Samsung witnessed varying degrees of decline, with only Realme and Xiaomi showing synchronous growth. Particularly impressive is Xiaomi’s 29% year-on-year growth rate, making it a significant dark horse on the list. Realme’s performance is also commendable, indicating that the decline in the domestic market hasn’t affected its presence in the Indian market. Based on the current trend, surpassing OPPO shouldn’t be a challenging feat.

I am the author, and the above reflects my insights. Creating original content is no easy task, so if you liked it, remember to follow for more content and engage through likes, shares, and comments. Stay tuned for more fascinating digital insights. Images are sourced from the internet; please notify for removal if necessary!