Resurgence of Chinese Smartphone Market Driven by Xiaomi and Huawei

The long-sluggish Chinese smartphone market has finally witnessed a moment of recovery, fueled by Xiaomi and Huawei.

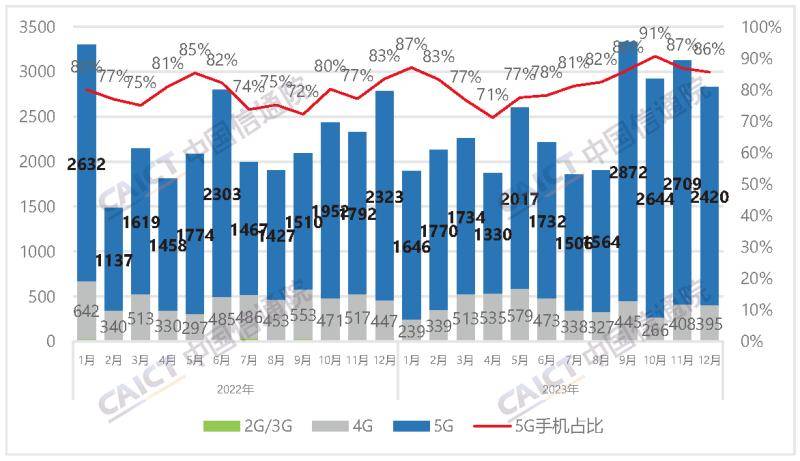

On January 22, the China Academy of Information and Communications Technology released an analysis report on the operation of the domestic smartphone market in December 2023 and throughout the year. According to the data, in December 2023, the domestic market saw a shipment of 28.275 million smartphones, a year-on-year increase of 1.5%. Among them, 24.2 million were 5G smartphones, marking a 4.2% increase year-on-year and accounting for 85.6% of the total shipments during the same period. For the entire year of 2023, the overall shipment volume in the domestic smartphone market reached 289 million units, reflecting a 6.5% year-on-year growth. Out of this, 240 million were 5G smartphones, showing an 11.9% increase year-on-year and constituting 82.8% of the total shipments during the same period.

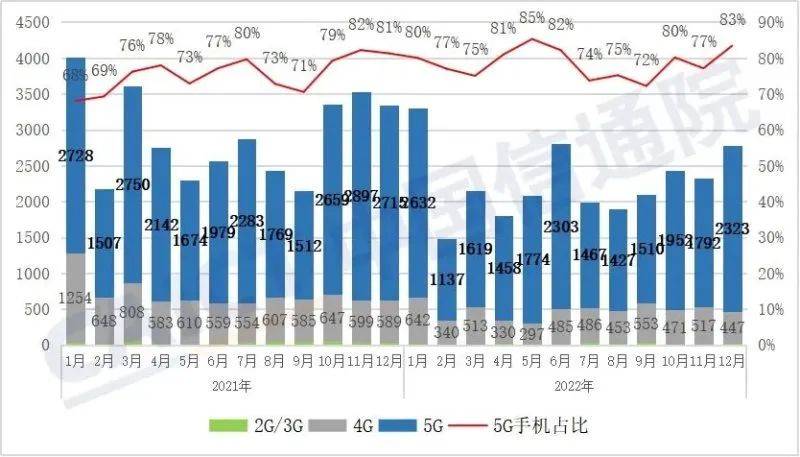

Similarly, data from the China Academy of Information and Communications Technology indicates that the total smartphone shipments in the domestic market for the whole year of 2022 were 272 million units, witnessing a 22.6% year-on-year decline. Out of these, 5G smartphone shipments stood at 214 million units, dropping by 19.6% year-on-year and accounting for nearly eight-tenths of the total shipments during the same period.

In 2023, with Huawei’s strong comeback and Xiaomi’s high-end strategy starting to bear fruit, the once stagnant smartphone market received a fresh impetus. Concurrently with the release of data by the China Academy of Information and Communications Technology, Lu Weibing, a partner at Xiaomi Group and general manager of the Redmi brand, reposted data from an authoritative data agency on his personal Weibo account, revealing that in December 2023, Xiaomi achieved an activation volume of 3.8409 million units and a market share of 16.5% in terms of sales revenue, surpassing Apple to claim the top spot in China’s smartphone market. Huawei and Honor also experienced rapid growth, with activations reaching 2.9411 million units and 3.3521 million units, respectively, translating to a sales revenue market share increase of 59.2% and 12.4% year-on-year.

Subsequently, Xiaomi’s founder Lei Jun also shared this data report on the morning of January 23, stating, “Last month, Xiaomi rose to the top spot in the Chinese smartphone market share! The competition among the top six brands in the Chinese market is fierce, and it’s not easy to secure the top spot!”

According to the financial data previously released by Xiaomi, in the third quarter of 2023, the gross profit margin of Xiaomi’s smartphone business reached 16.6%, a 7.7% year-on-year increase. Xiaomi’s smartphone business generated a revenue of 41.649 billion yuan, accounting for 58.7% of Xiaomi’s total income. Moreover, against the backdrop of continuous destocking, the overall inventory amount decreased by 30.5% year-on-year to 36.8 billion yuan, hitting the lowest level in eleven quarters, while Xiaomi Group’s cash flow resources continued to grow to 127.6 billion U.S. dollars. The release of the Xiaomi 14 series products also broke previous records, showcasing the initial success of Xiaomi’s high-end strategy.

The launch of the Huawei Mate 60 series products significantly stimulated consumers’ desire to upgrade their phones and led to a wave of replacements. Although there were initial supply shortages upon launch, feedback from the current market indicates that Huawei’s production capacity issues have been addressed. As per Tencent’s news outlet “Deep Web,” based on an interview with a core Huawei channel partner, compared to September and October 2023, the production capacity and stocking issues of Huawei’s 5G smartphones are gradually being resolved. The Huawei nova 12 Pro will be equipped with a new Kirin 8000 processor, the nova 12 Ultra will feature a Kirin 9000SL processor, and the nova series, as Huawei’s mid-range product line, will also be equipped with Kirin chips, further affirming the stabilization of Huawei’s smartphone supply chain. Blue Whale Finance journalists have not received an official response from Huawei regarding the above information.

In addition to the premium segment, Chinese smartphone manufacturers are also focusing on large models as a new battleground to stimulate consumers’ desire to upgrade. On November 1, 2023, at the vivo Developer Conference, vivo unveiled its self-developed AI large models and large model matrix, including five different parameter-scale large models of 175 billion, 130 billion, 70 billion, 7 billion, and 1 billion. Vivo also open-sourced the 7-billion-parameter Blue-heart large model 7B, becoming the first smartphone manufacturer to open-source self-developed large models. Huawei and Xiaomi have also made moves in this direction, such as Huawei’s HarmonyOS 4 supported by the Pangu large model, and Huawei’s smart assistant Xiaoyi will possess the ability of AI large models.

At the beginning of 2024, OPPO and Honor successively launched products equipped with AI large models. According to OPPO, the OPPO Find X7 is the world’s first mobile phone to apply a 7-billion-parameter large language model on the client side, and it has passed a new deployment of end-cloud collaboration. Honor stated that it aims to develop platform-level AI, reconstructing the underlying operating system with large models integrated for natural language understanding and resource allocation. The Honor Magic 6 series will be one of the first products to feature Honor’s large models.

From a global perspective, signs of recovery are also visible. According to a report by the market research firm Canalys, in the fourth quarter of 2023, global smartphone market shipments increased by 8% to reach 320 million units, ending seven consecutive quarters of decline. Quoting insights from IC design manufacturers, as reported by “The Paper,” the worst period of demand has passed, and the market is gradually recovering. With the introduction of generative AI in smartphones sparking an upgrade trend, it is expected that more significant signs of recovery will be felt in the third quarter of next year.

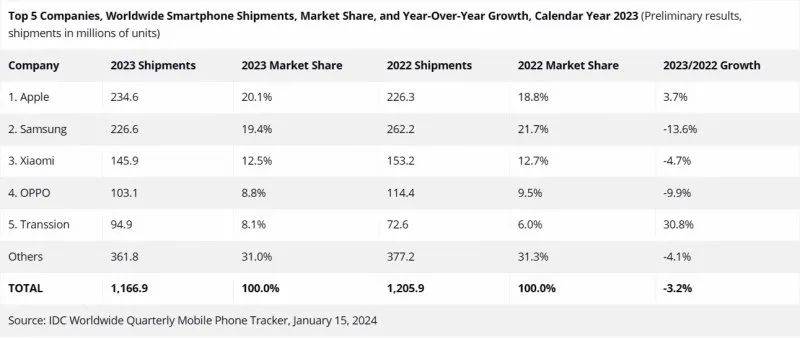

Furthermore, according to the latest data disclosed by IDC, in 2023, Apple surpassed Samsung for the first time to become the company with the highest global smartphone shipments, while Xiaomi ranked third, with shipments of 146 million units and a market share of 12.5%.

Original Title: “Xiaomi Overtakes Apple to Claim Top Spot in China, Lei Jun: It’s Indeed not Easy to Secure the Top Spot”