Quarterly Report Shows Growth in China’s Smartphone Market

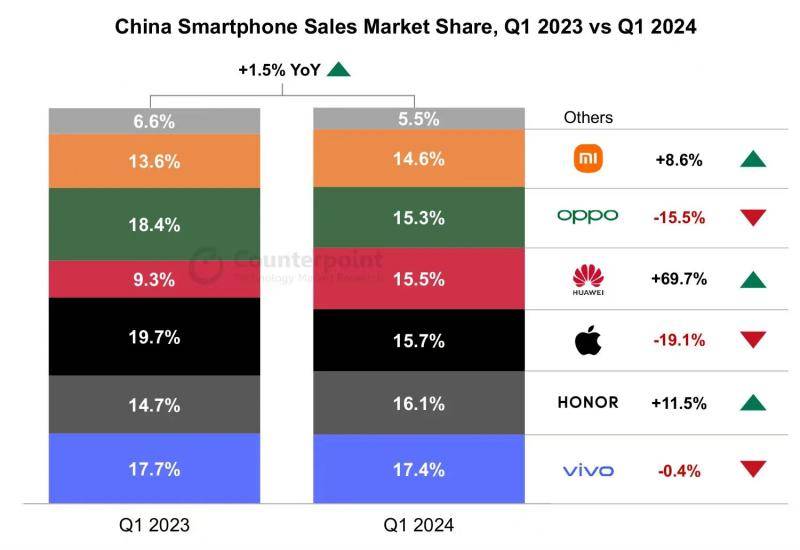

On April 23, according to Counterpoint’s weekly report on smartphone sales data, the first quarter of 2024 witnessed a 1.5% year-on-year growth in China’s smartphone sales, marking the second consecutive quarter of positive growth.

The report highlighted Huawei’s outstanding performance among all smartphone brands in the first quarter, with a remarkable 69.7% year-on-year growth. Huawei’s growth can be largely attributed to the successful sales of its 5G-supported Mate 60 series and its well-established brand reputation, leading to a significant increase in its market share in the high-end segment above $600. Despite Huawei’s strong comeback impacting other market players, Honor achieved a 11.5% year-on-year growth in the first quarter with several popular models and its expanding presence in offline channels.

Ethan Qi, Deputy Director of Research at Counterpoint, commented on market dynamics, stating, “With continuous growth in China’s smartphone sales and a 4.6% increase on a quarterly basis, a momentum of recovery seems to be building up. Sales promotions during the Chinese New Year period played a key role in driving this growth. According to Counterpoint’s data from the weekly model sales tracker of Chinese smartphones, average weekly sales in the four weeks leading up to the Chinese New Year increased by 20% compared to regular weeks.”

Mengmeng Zhang, Senior Analyst at Counterpoint, further elaborated on market dynamics, stating, “The first quarter of 2024 was highly competitive, with only a 3-percentage-point difference in market share among the top six vendors. Smartphone brands preemptively devised various marketing and promotional strategies, intensifying competition during holiday seasons. Especially during the Spring Festival holiday, the demand from migrant workers returning home for more affordable smartphones drove the surge in sales in the low-end market, allowing Chinese vendors to seize the opportunity with their competitive cost-effective products. This trend further narrowed the market share gap between major players.”

Ivan Lam, Senior Analyst at Counterpoint, commented on brand performances, saying, “vivo secured the top spot this quarter with a 17.4% share, driven by strong sales of Y35 Plus and Y36 in the low-end market and S18 in the mid-range market. Honor followed with a 16.1% market share, while Apple ranked third with a 15.7% market share. Due to Huawei’s strong comeback directly impacting Apple’s position in the high-end market, Apple’s sales performance was slightly underwhelming this quarter. Additionally, compared to previous years, Apple’s replacement demand also showed a slight softening.”

Looking ahead, Ivan foresees the possibility of iPhone sales resurgence. “We are witnessing a gradual but steady improvement in weekly sales, indicating a potential turnaround. For the second quarter, the introduction of new color options for iPhones, combined with proactive sales strategies, may lead the brand back to positive growth. Moreover, we look forward to Apple showcasing advancements in its artificial intelligence features at WWDC in June. In the long run, these factors could potentially alter the landscape.”

Counterpoint Research predicts a low single-digit year-on-year growth in the Chinese smartphone market. The emergence of generative artificial intelligence has prompted Chinese smartphone brands to integrate such features into their flagship devices. It is expected that smartphone brands will continue exploring new applications in AI and further integrate these AI applications into the mid-range market.

By Wen Jing, Beijing Youth Daily Reporter

Edited by Fan Hongwei