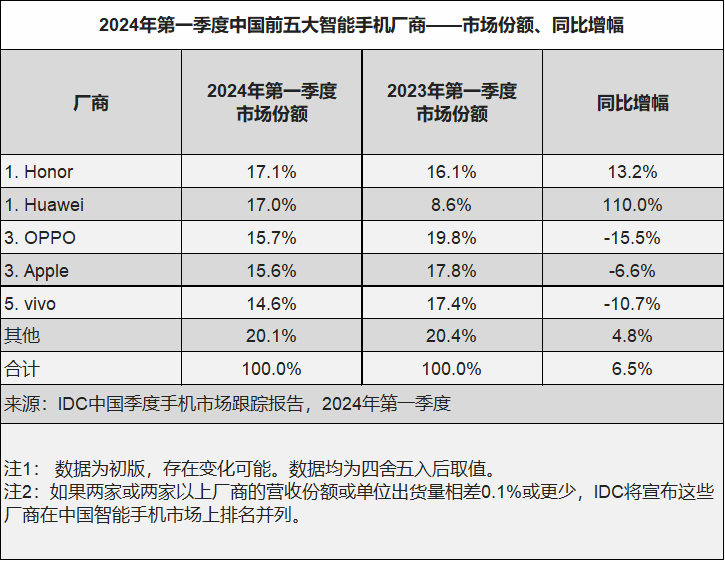

April 25, IDC released its latest quarterly tracking report on the Chinese smartphone market, revealing that in the first quarter of 2024, the overall shipment volume of smartphones in China reached approximately 69.26 million units, a year-on-year growth of 6.5%. This continued the steady growth trend from last year and exceeded market expectations.

The IDC report showed that in the first quarter, both Honor and Huawei were tied for the top spot in the Chinese smartphone market, with market shares of 17.1% and 17% respectively. Honor’s shipment volume grew by 13.2% compared to the previous year, while Huawei’s shipment volume increased by over 100%.

(Image source: IDC Consulting WeChat Official Account)

From the data, it is evident that Honor’s steady growth has led to it capturing the top market share in the domestic market in the first quarter of 2024, making it an important force driving the continued improvement of the market.

According to Wang Jiping, Vice President of IDC China, AI has become a key growth engine for Honor’s rise to the top. The brand’s new flagship, the Magic6 series, benefited from increased AI functionality, as well as comprehensive upgrades in imaging, screen quality, and other aspects. The first quarter’s shipments of the Magic6 series exceeded the combined shipments of the previous generation products in the first two quarters. Additionally, thanks to the promotion of the Honor Magic V2, which is equipped with platform-level AI, and other folding screen products, Honor’s market share of folding screen smartphones has seen the highest year-on-year increase of 675.4% since last year.

With the excellent performance of the Honor Magic6 series and the folding screen product line, Honor’s market share in the high-end smartphone market priced above $600 showed a significant increase in the first quarter of this year, with a year-on-year growth rate of 123.3%. Honor’s share in the high-end market is second only to Apple and Huawei.

Wang Jiping stated that Apple’s shipments declined by 6.6% compared to the previous year in the first quarter, indicating that domestic users may be gradually shifting their focus from continuous pursuit of smartphone iterations in previous years to being attracted by folding screen and AI phones in the high-end market.

According to IDC’s forecast, the new generation of AI smartphones will experience significant growth starting from 2024, leading to a new wave of device upgrades.

At the beginning of this year, Honor launched the AI-powered MagicOS 8.0, a full-scene operating system. Honor stated that by April, the user base of MagicOS 8.0 had exceeded 10 million and is expected to surpass 20 million by May and 40 million by June.

During the Honor Spring Flagship Product Launch Event on March 18, the brand further clarified its strategic direction in the field of AI, unveiling an AI-powered full-scene strategy and proposing a four-layer AI architecture. The first layer aims to use AI to integrate across systems and devices, enabling different operating systems to make decisions and achieve seamless connection and data sharing between smartphones, tablets, PCs, and other devices. The second layer focuses on reconstructing the operating system of a single terminal, making the device understand users better and become more user-friendly with continued use. The third layer consists of AI applications on the end-side, such as image editing, photo rendering, and document summarization. The fourth layer is the coordination between AI on the end-side and the cloud, presenting network-side AI, such as AIGC and large-scale neural networks, on smartphones while ensuring user privacy and security.

“Honor must first establish the core capabilities of platform-level AI or AI smartphones,” said Zhao Ming, CEO of Honor, emphasizing that this year, Honor will bring more innovative features to consumers in the third and fourth layers of AI applications.