IDC Report on China’s Smartphone Market in the First Quarter of 2024

On April 25, the International Data Corporation (IDC) released its latest quarterly tracking report on smartphones.

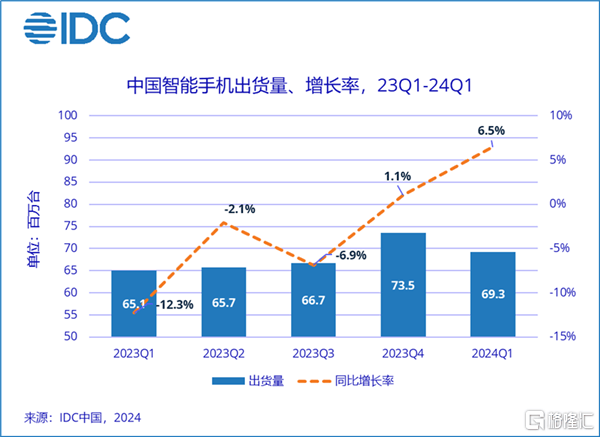

Overall, in the first quarter of 2024, the shipment volume of smartphones in China reached approximately 69.26 million units, a year-on-year increase of 6.5%. Similar to the global market situation, the continuous recovery of market demand has helped the Chinese smartphone market sustain the rebound from the end of last year, performing even better than expected.

The report points out that thanks to efforts from smartphone manufacturers like Honor and Huawei, the overall Android market in China saw a year-on-year growth of 9.3%. On the other hand, the iOS market continues to face significant pressure, with a 6.6% year-on-year decline. It is worth mentioning that the market share gap between top smartphone manufacturers is gradually narrowing, leading to intensified market competition.

Honor and Huawei Top the Chart

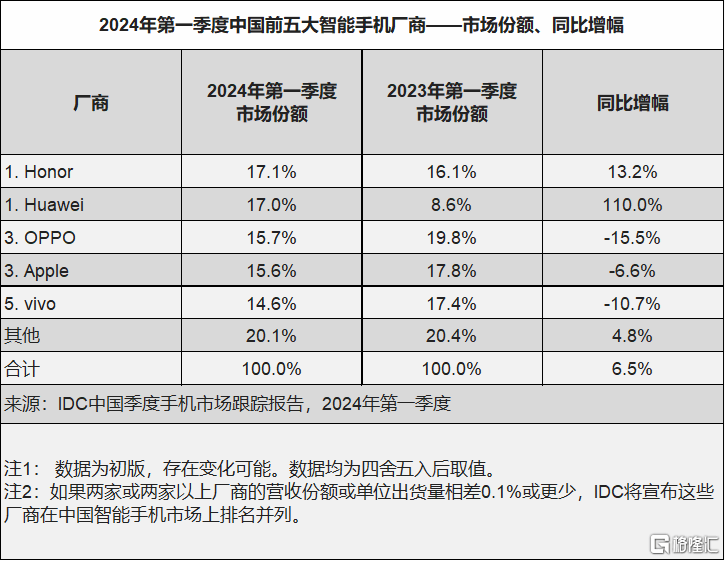

Looking at the market performance of major smartphone brands, Honor and Huawei jointly rank first in the Chinese smartphone market, followed closely by OPPO, Apple, and vivo.

Specifically, in the first quarter of this year, Honor achieved a market share of 17.1% in China, representing a 13.2% year-on-year growth. Boosted by increased AI functionality and upgraded features like imaging and display, the Magic 6 series became a bestseller, with first-quarter shipments exceeding the combined shipments of the previous generation in the first two quarters. Leveraging foldable screen products, Honor’s shipment volume in the high-end market above $600 saw a year-on-year increase of 123.3%.

Since its return at the end of August last year, Huawei has been experiencing rapid recovery. In the first quarter of this year, it tied for first place in the Chinese market with a year-on-year growth of 110%. Among its popular products, the Mate 60 series saw overwhelming demand, while the nova 12 series accounted for one-third of Huawei’s shipments for the entire quarter.

IDC indicates that supply chain issues remain a key limiting factor for Huawei’s further shipment growth. In the next quarter, with the comprehensive upgrade of the P series to Pura, the Pura 70 series, set to start afresh in a brand-new manner, is expected to help Huawei’s shipment volume continue to rise rapidly.

OPPO and Apple tied for third place in the domestic market, with OPPO witnessing a 15.5% year-on-year decrease in shipments, while Apple faced a 6.6% decline.

Through continuous promotion of AI, OPPO successfully boosted its high-end sales, with the new AI flagship series Find X7 surpassing the previous generation in shipments.

Although Apple has been adjusting prices and promotions, with the iPhone 15 Pro Max becoming the best-selling model during the Spring Festival period, it is increasingly challenged by competitors and urgently needs comprehensive hardware and software upgrades to attract consumers.

Vivo secured the fifth position with a market share of 14.6%, experiencing a 10.7% year-on-year decline in shipments. Amid intense competition in the domestic market, the company cautiously controlled shipments to alleviate channel burdens while enhancing cooperation with channels, showing outstanding performance in retail sales data.

Rapid Growth in Folding Screen Smartphone Market

In recent years, as smartphone updates have accelerated, a variety of styles and features have emerged. With the trend towards slim and affordable models, foldable screen smartphones have gained popularity, attracting a large number of consumers.

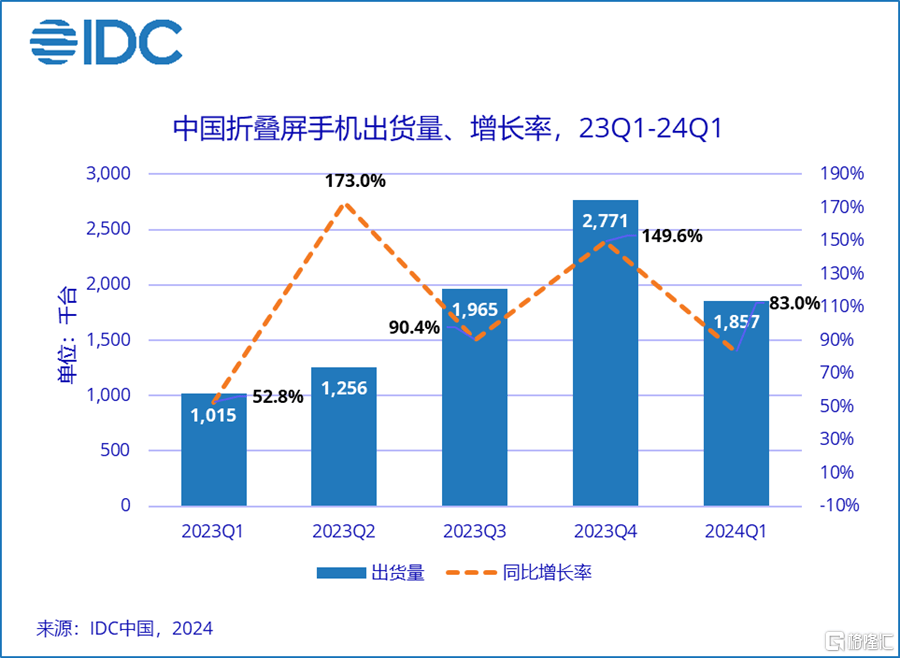

According to the IDC report, in the first quarter of 2024, the Chinese foldable screen smartphone market continued its rapid growth trend, with shipments reaching 1.86 million units, an 83% year-on-year increase.

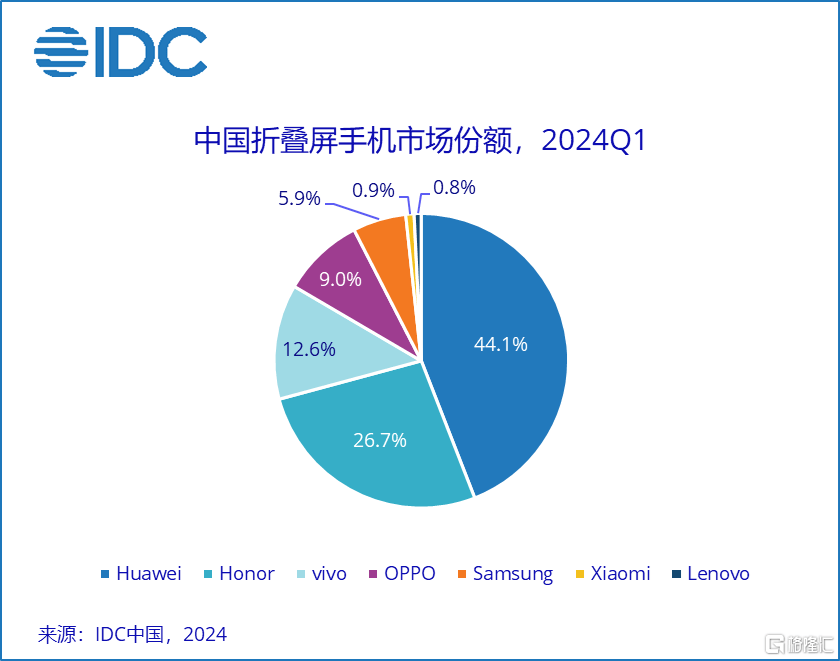

In terms of market share, benefiting from the popularity of Mate X5 and Pocket 2, Huawei maintained the top position. Since the release of the Magic V2, Honor has seen rapid growth in the foldable screen market, ranking second with a market share of 12.6% in the first quarter. vivo, OPPO, and Samsung ranked third to fifth, with market shares of 12.6%, 9.0%, and 5.9%, respectively.

IDC’s China Research Manager, Shi Guotianxiang, noted that despite the impact of last year’s lower “base period,” the Chinese smartphone market achieved a strong start in the first quarter of this year, indicating a positive industry trend.

Looking ahead, as global economies develop and smartphone technology advances, competition among major manufacturers will intensify.

Intense competition among brands will provide consumers with more choices. These trends reflect the future diversification and maturation of the smartphone market, hinting at significant development potential in the future.